First Commonwealth Federal Credit Union Informational Website

On request, any of the three nationwide consumer credit reporting companies can place a free fraud alert in your file to alert potential creditors that you may be a victim of identity theft; a fraud alert can make it more difficult for someone to get credit in your name because it tells creditors to follow certain procedures to protect you.

A fraud alert will help prevent someone from opening new accounts in your name. As soon as one credit reporting bureau confirms your fraud alert, the others are automatically notified to place fraud alerts as well. All three bureaus will mail you a confirmation letter and you will be able to order complimentary credit reports for your review.

The easiest way to place an alert is by visiting www.transunion.com or https://fraud.transunion.com/fa/fraudAlert.

You will answer some questions to confirm your identity, and then a 90-day fraud alert will be added to your credit file. TransUnion will give you access to view your report online. You should examine it carefully for accuracy. TransUnion will also share this information with Equifax and Experian who will both mail you confirmation letters containing a number to call to order complimentary copies of your credit reports for review.

To contact one of the credit reporting bureaus, please see below:

Equifax: 1-800-525-6285

PO Box 740260

Atlanta, GA 30374

Experian: 1-888-397-3742

PO Box 9554

Allen, TX 75013

TransUnion: 1-800-680-7289

PO Box 2000

Chester, PA 19016

It is only necessary to contact one of these bureaus and use one of these methods.

You will not be charged for this service. Please note placing a fraud alert may delay your ability to open new lines of credit quickly.

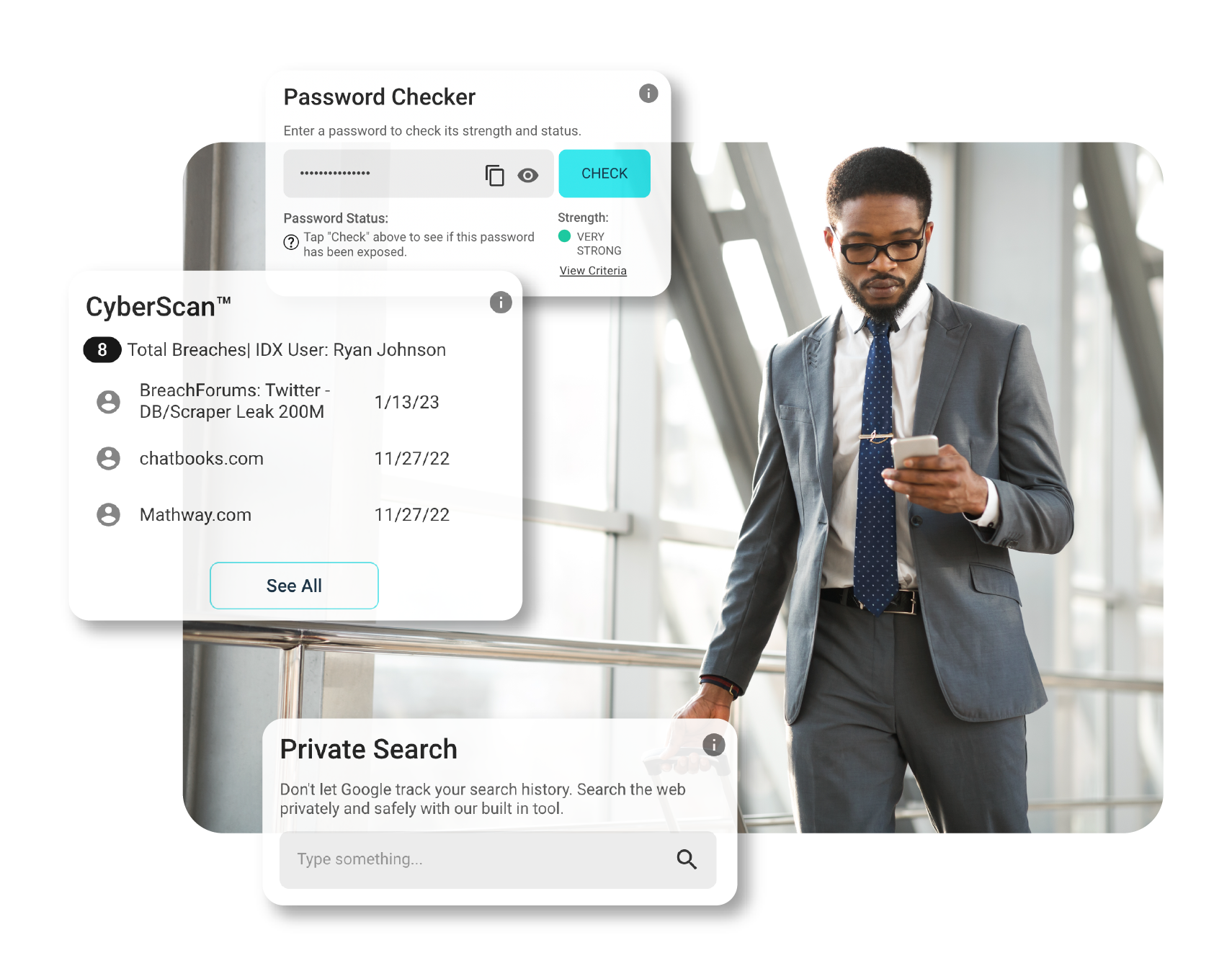

Whether or not you choose to enroll in the IDX identity protection program, you can order a copy of your credit report, for free, once a year from each credit reporting bureau. You can obtain a free credit report by visiting www.annualcreditreport.com or by calling 1-877-322-8228.

When you receive any credit report, you should review it carefully. Look for accounts you did not open. Look for inquiries from creditors that you did not initiate. Look for personal information, such as home address, employment or Social Security numbers, that are not accurate. If you see anything you do not understand, call the credit reporting bureau at the telephone number on the report.

If your credit report indicates fraud or identity theft, call your local police or sheriff’s office and file a report of identity theft. Get a copy of the police report. You may need to give copies of the police report to creditors to clear up your records. If you suspect that you may be a victim of identity theft and you have enrolled in the IDX identity protection program, you should contact them immediately. You will be able to speak with a knowledgeable advocate about your situation and, if needed, they will open a case to resolve the identity theft on your behalf.

Should you wish to learn more about identity theft and how to protect yourself, you may contact the Federal Trade Commission at 1-877-438-4338. The FTC website, www.consumer.ftc.gov, also offers additional information on identity theft that you may find helpful.

The security freeze (or credit freeze) is an option best reserved for people who have experienced extreme identity theft. Because the freeze essentially locks down your credit, it is not a good option for people who are simply seeking extra protection for their credit. We feel that credit monitoring, fraud alerts, and victim restoration services are more than sufficient options for defense against identity theft.

A security freeze will not prevent you from enrolling in our services. You can certainly sign up with us and do not need to lift the freeze to do so. The reason for this is because we do not request your Social Security number to enroll—only name, address, phone, and email. None of these items would necessitate a credit inquiry. However, a security freeze will affect your ability to activate the monitoring portion of your membership. To activate the monitoring portion you will need to temporarily lift your security freeze.

To learn more about security freezes and relevant state laws, contact your State Attorney General’s office or visit the Federal Trade Commission’s website for credit freeze information.

Please note that you must have an established credit file and credit history to place a fraud alert, a credit freeze or utilize www.annualcreditreport.com.