Get leading IDX identity theft protection

Brownwood, Texas – Landmark Admin, LLC (“Landmark”), located at 5750 County Road 225, Brownwood, Texas 76801, is writing to inform you of a recent data security incident that may have resulted in unauthorized access to some individuals’ sensitive personal information. Landmark is a third-party administrator for certain insurance carriers. As such, Landmark may have received certain of your personal information because you are or at one time were a producer, policy owner, insured, beneficiary, or payor for insurance policies which Landmark administered. This notice is intended to provide details about the incident, steps we are taking in response, and resources available to help protect against the potential misuse of sensitive personal information.

What Happened? On or about May 13, 2024, Landmark detected suspicious activity on its system. Upon discovery of this incident, Landmark immediately disconnected the affected systems and remote access to the network and promptly engaged a specialized third-party cybersecurity firm and IT personnel to assist with securing the environment, as well as to conduct a comprehensive forensic investigation to determine the nature and scope of the incident. The forensic investigation concluded on or about July 24, 2024, and determined that there was unauthorized access to Landmark’s network and data was encrypted and exfiltrated from its system. The unauthorized activity occurred from May 13, 2024 to June 17, 2024.

Based on these findings, Landmark began reviewing the affected systems to identify the individuals potentially affected by this incident and the types of information that may have been compromised. While this process remains ongoing, and in an abundance of caution, Landmark is notifying potentially affected individuals by mail on a rolling basis as they are identified. We determined that some of your personal information may have been affected by the incident.

What Information Was Involved? The types of information present in the compromised data varied by individual. Affected individuals will be notified by mail of information that was impacted. If you receive a letter, you can find the information potentially impacted under the “What Information Was Involved” section of the letter you received.

What We Are Doing? Data privacy and security are among Landmark’s highest priorities, and we are committed to doing everything we can to protect the privacy and security of the personal information in our care. Upon discovery of the incident, Landmark moved quickly and diligently to investigate, respond, and assess the security of its systems with the assistance of outside experts.

Landmark has also taken additional technical and administrative steps to further enhance the security of its systems and customer data to mitigate the risk of future harm. Specifically, Landmark acquired servers and deployed after server hardening, deployed a new firewall with the latest firmware, obtained new external IP address assigned by a new Internet Service Provider, implemented new domain controllers with new account naming conventions and forced new passwords, enabled BitLocker on all hard drives, reimaged all printers on the network, reimaged all network switches and updated to the latest firmware, and reimaged and updated all IoT devices with the latest firmware. Landmark also provided additional security training for all staff members, restricted all points of access to its systems, engaged a managed service provider to supplement the existing strong security posture with additional monitoring and protection software, and requires multifactor authentication for all devices (for both user and administrator logins). Landmark also notified law enforcement of this incident and this notice has not been delayed due to any law enforcement investigation.

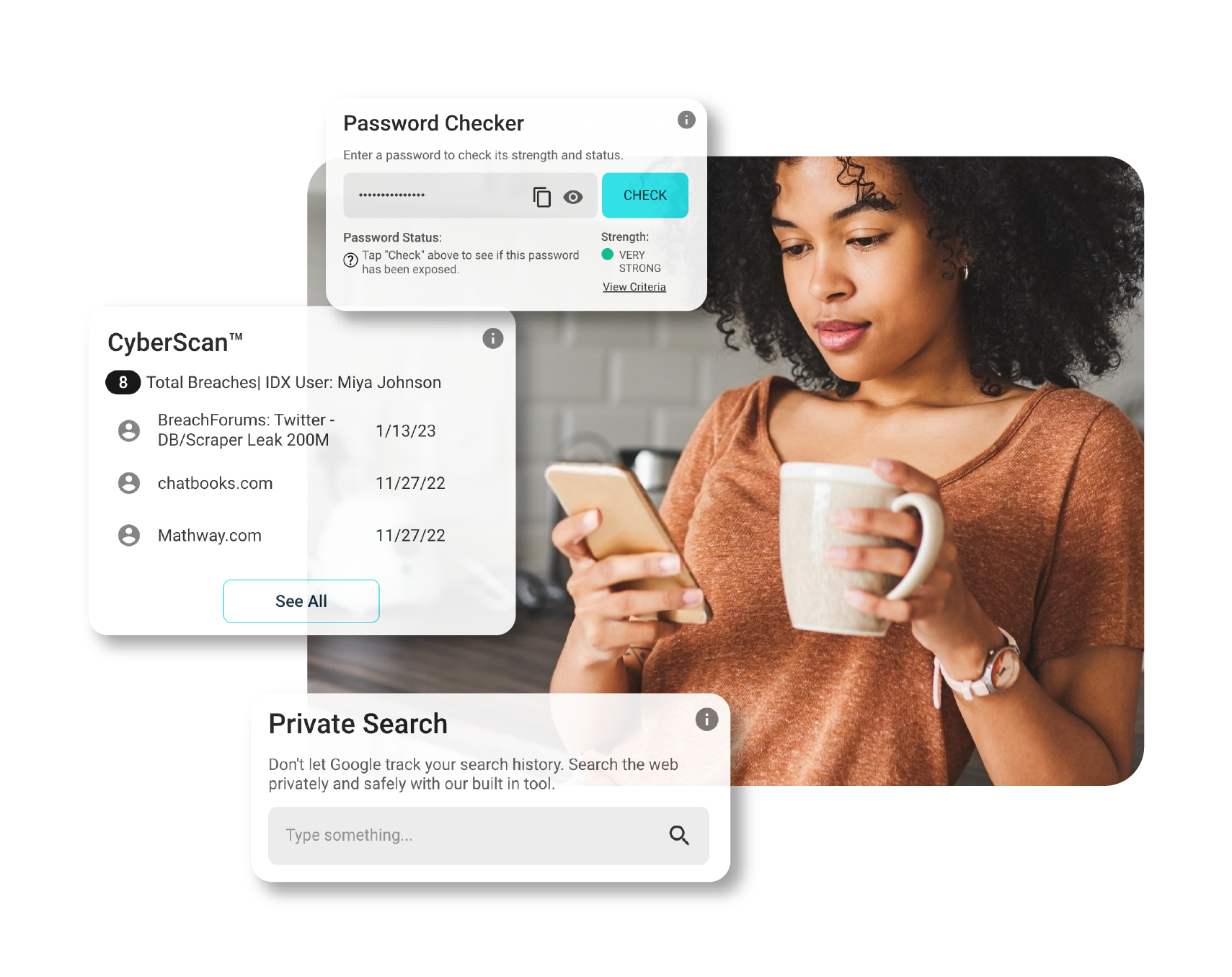

In addition, we are offering identity theft protection services through IDX, A ZeroFox Company, the data breach and recovery services expert. IDX identity protection services include: 12 months (or 24 months for residents of Connecticut, Washington D.C., and Massachusetts) of credit and CyberScan monitoring, a $1,000,000 insurance reimbursement policy, and fully managed id theft recovery services. With this protection, IDX will help you resolve issues if your identity is compromised.

What You Can Do: We encourage all impacted individuals to contact IDX with any questions and to enroll in the free identity protection services by calling 1-866-273-9228, going to https://response.idx.us/landmark, or scanning the QR image and using the Enrollment Code provided in your notification letter. IDX representatives are available Monday through Friday, during the hours of 9:00 a.m. and 9:00 p.m. Eastern Standard Time (excluding U.S. national holidays). Please note the deadline to enroll is 90 days from the date on your letter.

We also recommend that you remain vigilant and take steps to protect yourself against incidents of identity theft and fraud, including monitoring your accounts, account statements, and free credit reports for suspicious or unauthorized activity. Additionally, security experts suggest that you contact your financial institution and all major credit bureaus to inform them of such a breach and then take recommended steps to protect your interests, including the possible placement of a free fraud alert on your credit file. Please review the enclosed Steps You Can Take to Help Protect Your Information to learn more about how to protect against the possibility of information misuse.

Other Important Information: If you have any questions or concerns not addressed in this letter, you may contact IDX by calling 1-866-273-9228 (toll free) Monday through Friday, during the hours of 9:00 a.m. and 9:00 p.m. Eastern Standard Time (excluding U.S. national holidays). You can also go to https://response.idx.us/landmark or scanning the QR image to access an informational website. These resources will be available to you for 90 days after the date of this letter.

Landmark sincerely regrets any concern or inconvenience this matter may cause and remains dedicated to ensuring the privacy and security of all information in our control.

Sincerely,

Landmark Admin, LLC

STEPS YOU CAN TAKE TO HELP PROTECT YOUR INFORMATION

Monitor Your Accounts

We recommend that you remain vigilant for incidents of fraud or identity theft by regularly reviewing your credit reports and financial accounts for any suspicious activity. You should contact the reporting agency using the phone number on the credit report if you find any inaccuracies with your information or if you do not recognize any of the account activity.

You may obtain a free copy of your credit report by visiting www.annualcreditreport.com, calling toll-free at 1-877-322-8228, or by mailing a completed Annual Credit Report Request Form (available at www.annualcreditreport.com) to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA, 30348-5281. You may also purchase a copy of your credit report for a fee by contacting one or more of the three national credit reporting agencies.

You have rights under the federal Fair Credit Reporting Act (FCRA). The FCRA governs the collection and use of information about you that is reported by consumer reporting agencies. You can obtain additional information about your rights under the FCRA by visiting https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act.

Credit Freeze

You have the right to add, temporarily lift and remove a credit freeze, also known as a security freeze, on your credit report at no cost. A credit freeze prevents all third parties, such as credit lenders or other companies, whose use is not exempt under law, from accessing your credit file without your consent. If you have a freeze, you must remove or temporarily lift it to apply for credit. Spouses can request freezes for each other as long as they pass authentication. You can also request a freeze for someone if you have a valid Power of Attorney. If you are a parent/guardian/representative you can request a freeze for a minor 15 and younger. To add a security freeze on your credit report you must make a separate request to each of the three national consumer reporting agencies by phone, online, or by mail by following the instructions found at their websites (see “Contact Information” below). The following information must be included when requesting a security freeze: (i) full name, with middle initial and any suffixes; (ii) Social Security number; (iii) date of birth (month, day, and year); (iv) current address and any previous addresses for the past five (5) years; (v) proof of current address (such as a copy of a government-issued identification card, a recent utility or telephone bill, or bank or insurance statement); and (vi) other personal information as required by the applicable credit reporting agency.

Fraud Alert

You have the right to add, extend, or remove a fraud alert on your credit file at no cost. A fraud alert is a statement that is added to your credit file that will notify potential credit grantors that you may be or have been a victim of identity theft. Before they extend credit, they should use reasonable procedures to verify your identity. Please note that, unlike a credit freeze, a fraud alert only notifies lenders to verify your identity before extending new credit, but it does not block access to your credit report. Fraud alerts are free to add and are valid for one year. Victims of identity theft can obtain an extended fraud alert for seven years. You can add a fraud alert by sending your request to any one of the three national reporting agencies by phone, online, or by mail by following the instructions found at their websites (see “Contact Information” below). The agency you contact will then contact the other credit agencies.

Federal Trade Commission

For more information about credit freezes and fraud alerts and other steps you can take to protect yourself against identity theft, you can contact the Federal Trade Commission (FTC) at 600 Pennsylvania Avenue NW, Washington, DC 20580, www.identitytheft.gov, 1-877-ID-THEFT (1-877-438-4338), TTY: 1-866-653-4261. The Federal Trade Commission also encourages those who discover that their information has been misused to file a complaint with them. You can obtain further information on how to file such a complaint by way of the contact information listed above.

You should also report instances of known or suspected identity theft to local law enforcement and the Attorney General’s office in your home state and you have the right to file a police report and obtain a copy of your police report.

Contact Information

Below is the contact information for the three national credit reporting agencies (Experian, Equifax, and Transunion) if you would like to add a fraud alert or credit freeze to your credit report.

Experian

Access Your Credit Report

P.O. Box 2002

Allen, TX 75013-9701

1-866-200-6020

Add a Fraud Alert

P.O. Box 9554

Allen, TX 75013-9554

1-888-397-3742

https://www.experian.com/fraud/center.html

Add a Security Freeze

P.O. Box 9554

Allen, TX 75013-9554

1-888-397-3742

www.experian.com/freeze/center.html

Equifax

Access Your Credit Report

P.O. Box 740241

Atlanta, GA 30374-0241

1-866-349-5191

Add a Fraud Alert

P.O. Box 105069

Atlanta, GA 30348-5069

1-800-525-6285

www.equifax.com/personal/credit-report-services/credit-fraud-alerts

Add a Security Freeze

P.O. Box 105788

Atlanta, GA 30348-5788

1-888-298-0045

www.equifax.com/personal/credit–report-services

Transunion

Access Your Credit Report

P.O. Box 1000

Chester, PA 19016-1000

1-800-888-4213

Add a Fraud Alert

P.O. Box 2000

Chester, PA 19016

1-800-680-7289

www.transunion.com/fraud-alerts

Add a Security Freeze

P.O. Box 160

Woodlyn, PA 19094

1-800-916-8800

www.transunion.com/credit-freeze

Iowa and Oregon residents are advised to report suspected incidents of identity theft to local law enforcement, to their respective Attorney General, and the FTC.

Massachusetts residents are advised of their right to obtain a police report in connection with this incident.

District of Columbia residents are advised of their right to obtain a security freeze free of charge and can obtain information about steps to take to avoid identity theft by contacting the FTC (contact information provided above) and the Office of the Attorney General for the District of Columbia, Office of Consumer Protection, at 400 6th St. NW, Washington, D.C. 20001, by calling the Consumer Protection Hotline at (202) 442-9828, by visiting https://oag.dc.gov, or emailing at consumer.protection@dc.gov.

Maryland residents can obtain information about steps they can take to avoid identity theft by contacting the FTC (contact information provided above) or the Maryland Office of the Attorney General, Consumer Protection Division Office at 44 North Potomac Street, Suite 104, Hagerstown, MD 21740, by phone at 1-888-743-0023 or 410-528-8662, or by visiting http://www.marylandattorneygeneral.gov/Pages/contactus.aspx.

New York residents are advised that in response to this incident they can place a fraud alert or security freeze on their credit reports and may report any incidents of suspected identity theft to law enforcement, the FTC, the New York Attorney General, or local law enforcement. Additional information is available at the website of the New York Department of State Division of Consumer Protection at https://dos.ny.gov/consumer-protection; by visiting the New York Attorney General at https://ag.ny.gov or by phone at 1-800-771-7755; or by contacting the FTC at www.ftc.gov/bcp/edu/microsites/idtheft/ or https://www.identitytheft.gov/#/.

North Carolina residents are advised to remain vigilant by reviewing account statements and monitoring free credit reports and may obtain information about preventing identity theft by contacting the FTC (contact information provided above) or the North Carolina Office of the Attorney General, Consumer Protection Division at 9001 Mail Service Center, Raleigh, NC 27699-9001, or visiting www.ncdoj.gov, or by phone at 1-877-5-NO-SCAM (1-877-566-7226) or (919) 716-6000.

Rhode Island residents are advised that they may file or obtain a police report in connection with this incident and place a security freeze on their credit file and that fees may be required to be paid to the consumer reporting agencies.

Landmark Admin, LLC is offering IDX identity theft protection services which helps protect your identity with:

Credit Monitoring

Credit monitoring (for adults) that alerts you to any changes to your credit report

CyberScan™

CyberScan will monitor criminal websites, chat rooms, and bulletin boards for illegal selling or trading of your personal information

ID Theft Insurance

Up to $1,000,000 in insurance reimbursements, covering certain expenses that you may incur in responding to an ID theft event

Dedicated Experts

Access to Fraud Resolution Representatives to resolve identity theft issues

On request, any of the three nationwide consumer credit reporting companies can place a free fraud alert in your file to alert potential creditors that you may be a victim of identity theft; a fraud alert can make it more difficult for someone to get credit in your name because it tells creditors to follow certain procedures to protect you.

A fraud alert will help prevent someone from opening new accounts in your name. As soon as one credit reporting bureau confirms your fraud alert, the others are automatically notified to place fraud alerts as well. All three bureaus will mail you a confirmation letter and you will be able to order complimentary credit reports for your review.

The easiest way to place an alert is by visiting www.transunion.com or https://fraud.transunion.com/fa/fraudAlert.

You will answer some questions to confirm your identity, and then a 90-day fraud alert will be added to your credit file. TransUnion will give you access to view your report online. You should examine it carefully for accuracy. TransUnion will also share this information with Equifax and Experian who will both mail you confirmation letters containing a number to call to order complimentary copies of your credit reports for review.

To contact one of the credit reporting bureaus, please see below:

Equifax: 1-800-525-6285

PO Box 740260

Atlanta, GA 30374

Experian: 1-888-397-3742

PO Box 9554

Allen, TX 75013

TransUnion: 1-800-680-7289

PO Box 2000

Chester, PA 19016

It is only necessary to contact one of these bureaus and use one of these methods.

You will not be charged for this service. Please note placing a fraud alert may delay your ability to open new lines of credit quickly.

Whether or not you choose to enroll in the IDX identity protection program, you can order a copy of your credit report, for free, once a year from each credit reporting bureau. You can obtain a free credit report by visiting www.annualcreditreport.com or by calling 1-877-322-8228.

When you receive any credit report, you should review it carefully. Look for accounts you did not open. Look for inquiries from creditors that you did not initiate. Look for personal information, such as home address, employment or Social Security numbers, that are not accurate. If you see anything you do not understand, call the credit reporting bureau at the telephone number on the report.

If your credit report indicates fraud or identity theft, call your local police or sheriff’s office and file a report of identity theft. Get a copy of the police report. You may need to give copies of the police report to creditors to clear up your records. If you suspect that you may be a victim of identity theft and you have enrolled in the IDX identity protection program, you should contact them immediately. You will be able to speak with a knowledgeable advocate about your situation and, if needed, they will open a case to resolve the identity theft on your behalf.

Should you wish to learn more about identity theft and how to protect yourself, you may contact the Federal Trade Commission at 1-877-438-4338. The FTC website, www.consumer.ftc.gov, also offers additional information on identity theft that you may find helpful.

The security freeze (or credit freeze) is an option best reserved for people who have experienced extreme identity theft. Because the freeze essentially locks down your credit, it is not a good option for people who are simply seeking extra protection for their credit. We feel that credit monitoring, fraud alerts, and victim restoration services are more than sufficient options for defense against identity theft.

A security freeze will not prevent you from enrolling in our services. You can certainly sign up with us and do not need to lift the freeze to do so. The reason for this is because we do not request your Social Security number to enroll—only name, address, phone, and email. None of these items would necessitate a credit inquiry. However, a security freeze will affect your ability to activate the monitoring portion of your membership. To activate the monitoring portion you will need to temporarily lift your security freeze.

To learn more about security freezes and relevant state laws, contact your State Attorney General’s office or visit the Federal Trade Commission’s website for credit freeze information.

Please note that you must have an established credit file and credit history to place a fraud alert, a credit freeze or utilize www.annualcreditreport.com.